Money Supply refers to the total volume of money held by the public at a particular point in time. It has implications on the aggregate demand of an economy, and thus on inflation. In order to maintain the level of liquid money flowing through the economy, bank regulators influence the money supply through policy and framework decisions.

A Brief History

Since 1944, the world had followed the Bretton Woods system for foreign trade and exchange. This system required the external value of currency to be pegged to the U.S. dollar, which was in turn pegged to the price of gold. However, throughout the 60s, the United States had difficulties in maintaining the market value of the dollar near its parity value. It was noticed by President Richard Nixon that the U.S. gold reserves could not meet the amount of dollars in circulation. Thus, the system collapsed.

Since the end of the Bretton Woods system in 1971, various governments around the world stopped pegging the external value of their currency to the U.S. dollar. The U.S. dollar became a fiat currency. The new system, called the Managed Floating Rate system, would have exchange rates determined by market forces, with central banks aiming to control money supply to check inflation/deflation in the economy.

The Federal Reserve, also known as the Fed, took to controlling the money supply in the economy.

The Effect of Money Supply on Economic Activities

A rise in the money supply generally leads to a decrease in interest rates. Consequently, this prompts an upswing in investments and provides consumers with more funds, thereby encouraging increased spending. In response, businesses tend to increase their orders for raw materials and ramp up production, leading to heightened demand for labor.

Conversely, a decrease in the money supply or a decline in its growth rate can result in reduced lending by banks. This, in turn, causes businesses to postpone new projects, and there is a decline in consumer demand for home mortgages and car loans.

Money Supply-How to Control it?

The central bank of a country uses many tools to control the quantity of money in an economy. It attempts to limit the credit creating power of commercial banks to limit aggregate spending (demand) in an economy.

- When money supply is excessive, it attempts to raise the cost of borrowing for the consumers from commercial banks, thus discouraging loans and reducing consumer spending and investment.

- When money supply is deficient, it attempts to reduce the cost of borrowing for the consumers from commercial banks, thus encouraging loans and raising consumer spending and investment.

The Monetary Policy is the policy of a central bank in the direction of controlling money supply.

There are various tools of monetary policy which are used to control money supply. These include:

- Repo Rate: It is the rate of interest at which the central bank lends money to the commercial banks to meet their short-term needs.

- Bank Rate: It is the rate of interest at which the central bank lends money to the commercial banks to meet their long-term needs.

- Reverse Repo Rate: It is the rate of interest at which commercial banks can park their surplus funds with the central bank.

In all of the above instruments, an increase discourages consumer borrowing by making loans expensive, thus reducing money supply.

- Open Market Operations: It refers to the selling/purchase of government securities by the central bank from/to the public/commercial banks. The purchase of securities increases money supply as it increases the reserves of the banks and vice versa.

- Legal Reserve Requirements: They stipulate a minimum percentage of funds to be kept by the commercial banks as reserves. A decrease increases the amount of credit to the public and thus raises money supply.

- Margin Requirements: It refers to the difference in amount of loan and the market value of the security offered by the borrower against that loan. A decrease makes loans easier and thus raises money supply.

- Selective Credit Controls: The central bank attempts to encourage or discourage credit in different scenarios through credit rationing to influence money supply.

- Moral Suasion: The central bank attempts to influence private ventures to take/not take credit.

Measures of Money Supply

There are two main measures of money supply: M1 and M2

- M1 Money Supply: It is commonly referred to as narrow money, and is frequently used interchangeably with the term “money supply” in financial media reports. It encompasses the total count of all notes and coins in circulation, whether held in an individual’s wallet or a bank teller’s drawer, along with other easily convertible money equivalents. An example of such an equivalent is a standard bank savings account, as the account holder has the ability to promptly convert those savings into cash at any time

- M2 Money Supply: It includes M1 money supply, but also short-term time deposits in banks and money market funds.

Money Supply in Different Economic Theories

Economists disagree on the root cause of inflation. There are different schools of thought, such as Monetarism or Keynesianism, which propound different reasons for the phenomenon of rise in the general price level of an economy.

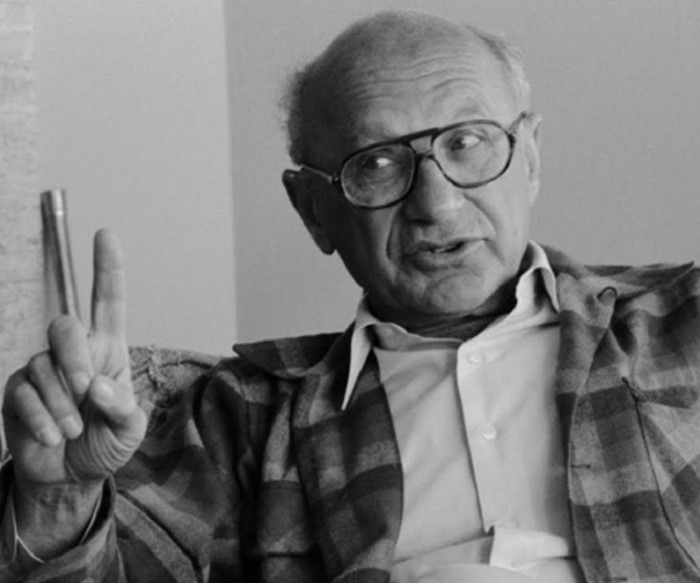

In Monetarism, largely contributed to by economist Milton Friedman, money supply is considered the biggest driver of demand in an economy. Increasing the money supply raises the level of aggregate demand in an economy and leads to inflation.

Friedman was opposed to the idea of a Federal Reserve, but supported in theory policy tools to limit the supply of money in an economy with an aim to achieve price stability.

In Keynesianism, based on the ideas of John Maynard Keynes, it is propounded that money supply by itself is not sufficient to influence economic activity of an economy.

Greater weight is given to fiscal policy, including taxation and expenditure policy, to drive demand. Inflation is caused by excessive governmental spending.

Conclusion

While there is convergence between reducing money supply and reducing inflation, a substantial reduction in money supply may also slow down employment and economic growth; and while increasing money supply can stimulate growth in an economy, a substantial rise causes high rates of inflation. There is a delicate balance to money supply is an economy which all central banks attempt to preserve, in the hope of ensuring the welfare of citizens.

Note: I have taken the photographs/illustrations from internet. They belong to the author/photographer/designer of the original article/s.